Build wealth like the pros!

If you’re on a slower path to wealth than you would like, this is the post for you. No wealth whatsoever? Even better. Let’s get you started. There are the special hacks that will help a lot: marrying into money, inheriting a bundle, lottery winnings or working somewhere with a juicy stock option plan. If none of those are in the cards, not to worry. Turns out, there are just 4 factors to tweak to build wealth like the pros. Which one is the biggest issue for you? Read on and let’s find out!

Factor 1 – Rate of return

As you save money and invest those funds will grow. How much? That depends on the rate of return. If you want to build wealth like the pros, that is the first place to look. For a quick perspective, the Rule of 72 is a handy way to understand the impact. If you divide your percentage return into 72, the result is the number of years it will take to double your money. As an example, at 7% return, it would take about 10 years to double your money. At 2%, it would take 36 years. Ouch! That’s a big difference. No Lamborghini for you. And if inflation was running at 2%, you would be getting exactly…nowhere. Now you know why having all of your money invested in savings accounts, treasury bills and GICs won’t work.

Compare to the Indexes

How are you doing on your rate of return? Go back and take a look. For business, the rate of return should be quite clear from the business statements. For savings with an investment firm, your rate of return should be available on your statements or online. In the case of equity investments (stocks) the question is whether, after all fees, they exceeded the overall stock index. For the US market the index is usually viewed as the S&P 500. It has averaged about 8% over time. If your investments are trailing that, it’s time for a review with your investment advisor. Investing on your own, maybe it’s time to invest in the overall index. By definition, if you are investing in the index, you can’t be underperforming it. Also, maybe act on fewer “hot” stock tips from your Uber driver.

It’s important to compare like for like investments to the indexes. That is to say, compare your US stock portfolio to the US stock index. Likewise with bonds, European stocks etc. Here are the common indexes to use as benchmarks:

- US Stocks – S&P index

- European Stocks – STOXX Europe 600

- Canadian Stocks – S&P TSX index

- Global Bonds – Merrill Lynch Global Bond Index

These are just examples of some indexes for comparison. Find one that works and compare your investment returns.

Factor 2 – time

Assuming you are getting a great rate of return, the next big factor is time. Compound interest is the 8th wonder of the world, but time is the magic that really sets it ablaze. To illustrate, let’s go back to the Rule of 72. As we said earlier, at 7%, money doubles every 10 years or so. Cool. But it doesn’t stop there. It keeps doubling every 10 years. Let’s say that you had $100,000 invested at 7%. After 10 years it would double to $200,000. So 10 years later it would be $400,000, then $600,000 and $800,000 after a total of 40 years. Wow! that is a pile of money. OK, now let’s see who was napping during that math! It actually doubles every 10 years. So the real math is $200,000, then $400,000, then $800,000. After 40 years, it hits an astonishing $1,600.000!

Enjoy now or save for later?

Well that is a big pile of money, but who wants to wait 40 years to get rich? Great question. There are three parts to this. First, if you are 20 right now, 40 years from now you will be 60. Which isn’t all that old. Trust me, I’m almost there. I can still run, ski, play the guitar, and bike. And the mortality tables tell me that I still have another 30 years or so to go. So I’m glad that I followed my own advice and earned a good return and let that money grow over time. Second, you aren’t waiting for all of your money to grow like that, just the part that you are saving. The rest you can spend and enjoy through all of those years. Third, let’s go back to that $1,600,000. That means that every dollar you set aside and invest at 7% becomes $16 in 40 years. That is a big difference vs spending that $1 now.

But how much should you save and how much should you spend? That leads us to our next factor in how to build wealth like the pros.

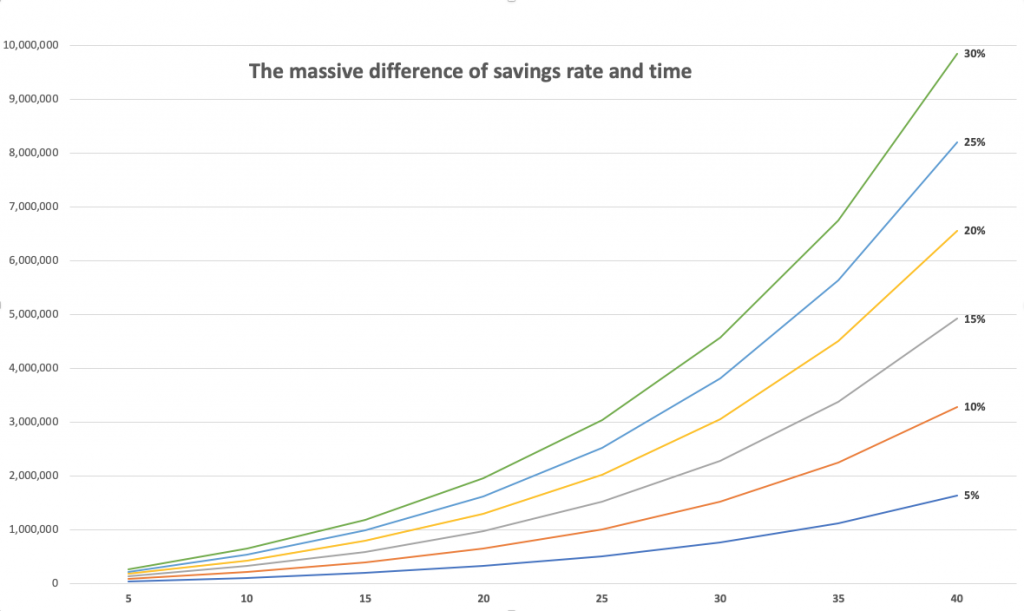

Factor 3 – Savings Rate

Savings rate is just the percentage of your gross income (before deductions for taxes and other things) that you set aside to build wealth. So if you earned, say $100,000 and saved $10,000, your savings rate is 10%. If you saved $15,000 on that same income, your savings rate would be 15%. But how much difference does the savings rate really make? Is it really worth it to increase your savings rate from 10% to, say, 15% or 20%? Let’s take a look:

In the graph above, we see the difference that savings rate makes. To provide context, the graph is based on a household income of $150,000 with the savings earning 7% annually. Saving 5% of that would be $7,500 a year, or $625 a month. At a 5% savings rate, after 30 years, we would accumulate $762,000. Not bad! But saving 10%, we would accumulate $1,526,000. Quite the difference. After 40 years, the 5% saver would have $1,640,000 while the 10% saver would have $3,281,000. Of course, someone who enjoyed all of their income and saved nothing would have, well, nothing. Not a great retirement. Or maybe working longer than you had hoped. So savings rate is a key to build wealth like the pros.

And there are other ways to look at this chart. As an example, let’s say you wanted to retire early. At a 5% savings rate, you would accumulate $1,126,000 after 35 years. But with a 10% savings rate, you could gather the same amount after just 27 years. That’s 8 years to whack white balls across the countryside, build a school in Kenya, or just bask in a hammock sampling Pina Coladas.

What counts in savings rate?

Another good question. It’s anything that builds wealth. For instance, contributing to a registered education plan is a great thing to do, since the government helps you save more effectively. But it doesn’t contribute to your long term wealth. Joining the company pension plan does count. If you want a 10% savings rate and your pension plan contribution is 6% of your gross, then you would need to save another 4% elsewhere. If you had a high interest mortgage or other debt, applying accelerated payments would count since the “return” is guaranteed and eliminating that debt would help build your long term wealth. Just make sure that you aren’t living beyond your means, continuously racking up debt, then paying it off. That doesn’t count! Nice try though!

What if you can’t scrape together a decent savings rate?

There are tons of ways to save on just about every category of spend. I spent 2 years finding the best ideas, in fact, $13,000 of monthly savings ideas. Check it out here. And be sure to subscribe to this blog so you don’t miss anything. No spam, no passing your information to foreign hackers. Just you and me building your wealth!

One more trick to build wealth like the pros

Saving any amount might seem daunting. But 4% is better than 2% and 2% is better than nothing. Build the savings habit, establish some sort of automatic savings plan that snatches the money before you can. A company stock purchase plan, an automatic monthly transfer to an investment account or a government registered plan. Start with a small percentage and step it up a bit at a time. If you do it just as you get a raise, you literally won’t notice the difference. Maybe enjoy half the raise and use the rest to crank your savings rate up an extra 2 or 3%. Then do it again next raise. It’s worth it.

And there is one more way to build wealth like the pros:

Factor 4 – Income

On the one hand, this is a bit obvious. Doesn’t everyone who earns a lot end up rich? Well, actually not. Ask Mike Tyson, MC Hammer, Nicolas Cage, Toni Braxton, 50 Cent, Kim Basinger, Michael Jackson or Burt Reynolds. If you spend as much as you earn, or more, you will go broke no matter how much you earn.

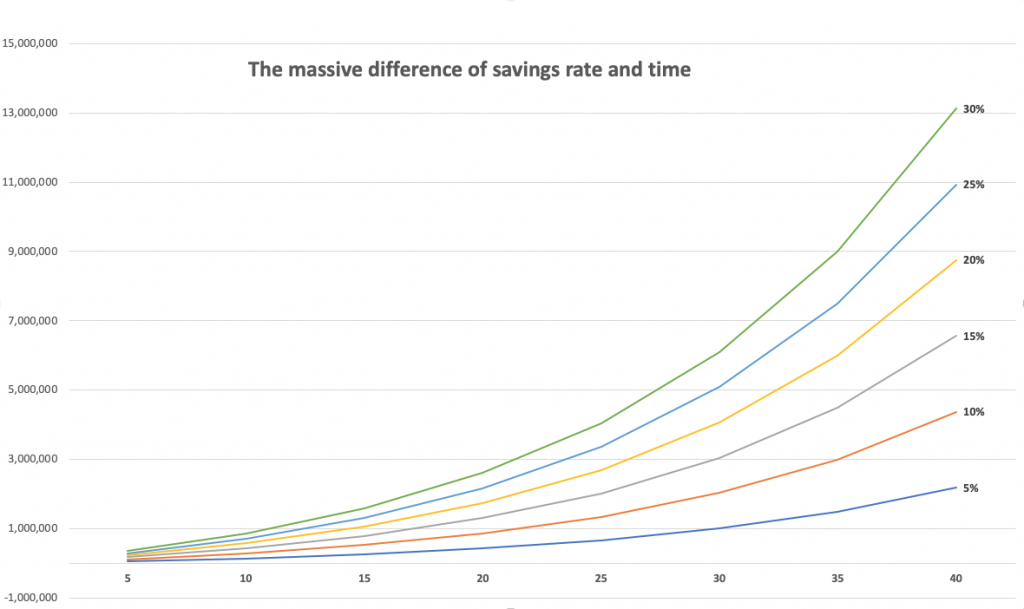

But what happens if we keep everything else the same, but increase our household income from, say, $150,000 to $200,000? Let’s take a look at the chart with the new numbers:

No surprise. All of the numbers get bigger. As an example, a 20% saver earning $150,000 would accumulate $3,049,000 over 30 years, while the 20% saver earning $200,000 would pile up $4,066,000. Whoa! An extra millski. And it shows that increasing your earnings is another key to build wealth like the pros.

What did I miss? What aha’s did you have? Let me know in the comments. If you enjoyed this, please share it with the social buttons.