One of the fun features of money is that there are so many ways to worry about it. The FIRE (Financial Independence, Retire Early) crowd are worried that they aren’t saving enough to be able to pack it in at 35. And fiercely jealous of their friends who just retired at 32. Retirees are worried that they will outlive their savings. Graduates worry about paying off their student loans. CEOs worry that they will look limp when their peers outshine them on the Bloomberg highest paid reports. But the real worry happens when people live pay check to pay check and struggle each month to make ends meet and to decide which bills get paid. Studies put that number at around 50% of American households. CNBC estimates that the number has risen to 63% due to Covid-19. And Canadians aren’t much different with 53% living paycheque to paycheque. And it happens at all income levels. Ask Nicholas Cage or Mike Tyson.

So how to stop worrying about money?

A solution lies in the new frugality movement. Over at fellow blogger, Mr Money Moustache, he reveals his annual budget for his “luxurious” lifestyle of around $20,000. Netflix has some great shows on tiny homes with couples crawling over each other to cook dinner. Or we could find stock market “hidden value gems” like GameStop and hope that the upward momentum carries on forever. (Didn’t end well.) Then there is a popular approach called “budgeting” where couples or families guess targets for each category of spending, then assign blame at month end as the targets are voraciously breached. Its a bit like the quarterly business review process at a company. But more violent.

Tell me I don’t have to give up my avocado toast

But most of us don’t want to give up our lattes, avocado toast and daily glass of wine. We want a home big enough that we don’t have to store groceries under our beds, we don’t want to gamble on risky investing ideas and there doesn’t seem to be much fun in budgeting. So how do we build wealth without BS (Budgeting and Sacrifice)?

Can you read your way to financial wellness?

From about age 25 to 30, I set a goal to read one personal finance book a month. I read about Benjamin Graham, Warren Buffett, Peter Lynch and the investing greats, loved the Wealthy Barber, The Automatic Millionaire and Rich Dad, Poor Dad. My nightstand held The Single Best Investment, The Richest Man in Babylon and How to Get Rich. The habit continues, recently reading books from some Canadian colleagues including Rich is a State of Mind, Burn your Mortgage, Beat the Bank and Wealthing like Rabbits. Which to choose? At about $25 each, the return will dwarf any other investment you will make. Go. Buy. Borrow. Learn!

Good concepts, but hard to do

Most of these books advocate a simple set of rules that take a lifetime to soak into our thick noodles. Live within your means, save 10% or more of what you make, then get that money working for you in stocks, bonds, real estate or a business. For financial investing set an investment allocation plan (stocks, bonds, real estate, cash) choose stocks or funds more cleverly than everyone else, buy and hold, minimize investing costs and be smart on your taxes. Pretty basic and incredibly powerful. But most of them run counter to our basic human instincts. Even though the advice is sound.

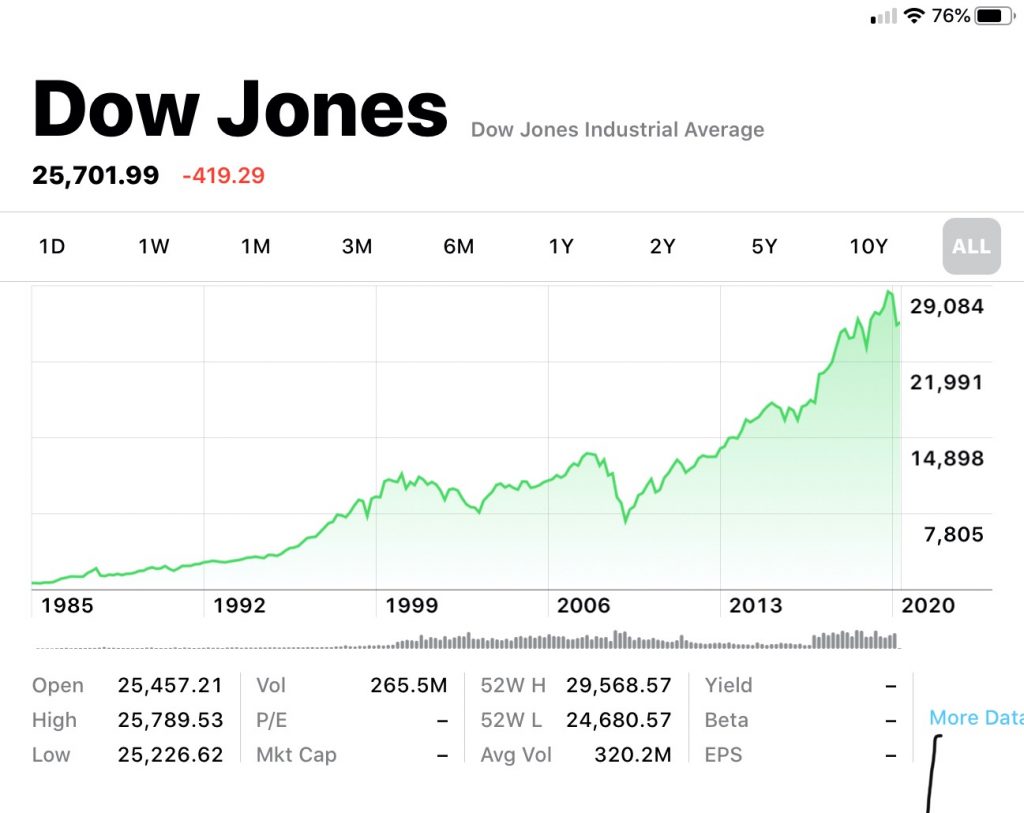

- Who wants to buy stocks when prices are falling? Hmm. You don’t like it when things go on sale?

- What if the markets tank right after I buy? They may, but they are extremely likely to rise over 10 or 20 years.

- Do I keep holding? This stock has done nothing all week! Set down your phone and go for a walk.

- Who wants to own bonds when they yield next to nothing? They might be helpful during market downturns.

- Who wants to be a landlord and deal with leaky toilets? It might be a path to wealth.

Where’s the fun in saving 10% of my income?

Let’s go back to the part about saving 10%. Where’s the fun in that? So much cool stuff to buy. And the money goes so fast. Often there is nothing left after the necessary expenses, last month’s credit card bill, the car payments, the mortgage, some nice dinners out, a new iPhone and a few other splurges. And why save anyway? Who knows how long we will be here – might as well enjoy it now. So if there is no way to save 10% (or, worse, anything at all), the whole plan gets derailed and we are back to waiting for each pay check. No financial freedom and we’ll need to learn to love our jobs. For a long time. How to stop worrying about money?

Saving starts the process. It builds a flock of special geese that lay financial eggs like interest and dividends. Keep trading-in those eggs for more geese and the process accelerates. Do it right and you will get to the point of financial wellness. That’s when those financial eggs show up dependably into your bank account every month, pay for all the bills, travel, great food and smooth scotch you can handle. All while you are doing, well, whatever you want. But it all starts with saving, and that’s about as much fun as dieting. It seems like a zero sum game. Save for tomorrow or enjoy today?

Is there a way to save for the future and enjoy today?

Back in 2015, I started thinking about this problem. I discovered a couple of nifty ways to save on car washes and home alarm monitoring. Both with minimal effort and minimal sacrifice. What other ideas were out there? I started a list. Then calculated what would happen if the savings were used to pay down debt or if they were invested. The list became a spreadsheet. The spreadsheet became a book, a blog, a newspaper column and a speaking career. Turns out the savings are material, Cashflow Cookbook includes over $13,000 of monthly savings ideas. Yes monthly. In every category like housing, transportation, food, household, lifestyle and financial. Will all of them work for you? Unlikely. But are there a few ideas that could save you $200 to $2,000 a month? Likely. Commit that money to debt pay-down or more investments and your wealth will soar.

Your money worries are fixable

The experience has changed my life and I know that the ideas can change yours. Helping others learn how to stop worrying about money feels great. But if it’s a beautiful day, I go for a bike. If it’s rainy, I get out a guitar or read a book. I rarely set an alarm and I spend as much time as I can with my wife, family and friends. Thank heavens for Zoom and free long distance. When the pandemic ends, some great travel will begin. Bills are on autopilot and money worries are long gone.

Your money worries are fixable. Now is the time to do it.

- Stop living pay check to pay check

- End the bickering about money

- Don’t sacrifice your life for money

- Cease your savings challenges

- Replace budgeting with enjoying life

- Abandon your retirement worries

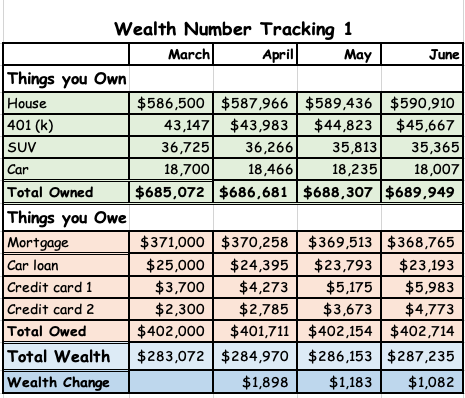

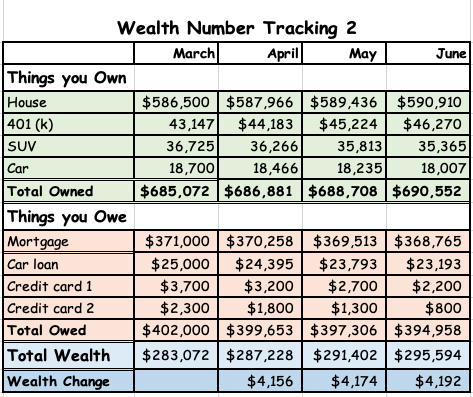

In How to Stop Worrying About Money Part 2 we will look at a simple model to get started, a fun way to track your progress, the incredible power of some painless changes and the simple steps you can take right away.

Stay safe. Enjoy life.

Gordon

Photo credit Pixabay