In Part 1 we looked at how to stop worrying about money and found a few key themes. One is the tug of war between enjoying money now and saving for the future. We touched on the idea of saving 10% of our incomes with a vague notion that can set us up for financial bliss. We saw some tested financial concepts from the experts, but damn they are hard to implement. Another tug of war. But we also hinted that there is a way to actually get to financial wellness. Heck, let’s aim for financial joy.

What we will find is that we can eliminate these financial tugs of war and get the debt to fade away and the wealth to build, month after month.

Your wealth will start growing when you track it

If we want to lose weight, a thermometer is of little use. Driving a car, it’s difficult to discern the speed by checking the rear view mirror. If you want to build wealth, you need to track your wealth. What you own, minus what you owe. It’s just one number. If it is rising, you are building wealth. If it is falling, you are losing wealth. Knowing that number and tracking it over time is the simplest and most powerful thing you can do. It changes everything and makes you think about the implications of your spending decisions.

- Should I bother to renegotiate my cell phone plan? Yep. The one hour call might save you thousands over the next few years. Turns out calling your cell phone company is a powerful return on your time.

- Is it worthwhile to add a swimming pool to our house? Not unless you really love it. You are unlikely to recover the costs with the new buyers. And the maintenance costs and the $400 a month or so to heat it might add up to hundreds of thousands of missed investment opportunity. See below.

- What kind of car should I buy? Up to you, but know the cost difference over the time you’ll own the car. Here is an example.

- Is there a cheaper way to get prescription drugs? There sure is! Have a look here.

Write a best selling wealth app, or just borrow a cocktail napkin and a pen from a bar or download my template, but get started on tracking your wealth. Use your records to go back a few months to see how things have been going. As you make decisions, think about what they do to your wealth. Start tracking it today. That’s your first piece of homework.

For lots more details, read my post on tracking your wealth.

Einstein was correct about compounding

“Compound interest is the eight wonder of the world. He who understands it, earns it. He who doesn’t pays it. “ – Albert Einstein.

When I was first working, there were lots of wise grownups counseling me to save my money. Interest rates were around 5%. So if I were to, say, save $1000 in my first year of work, at 5% interest I would have made $50 in interest at the end of the year. The tax man might take $20, leaving me with $30. Big deal. So I could go for lunch at the end of the year. Clearly the advice made no sense.

So I lived well. Nice apartment. new car (complete with loan). Some student debt. Floating some restaurant and bar debt on a credit card. I could almost squeeze everything in each month. I never heard the Einstein quote, but I was living the dark side of it. A big part of my income went to paying debt. And that interest was dragging my wealth backward. It was fun to be earning and buying new things but I was building no wealth. Stuck on an earn and spend treadmill. I wish I knew then how to stop worrying about money.

Change your money relationship

Scientists talk about a brain chemical called dopamine. It fires up when we get a pleasure hit of some sort. Buying a new pair of jeans – light hit. Picking up a brand new car – medium hit. Closing on a fancy new home, whoa, – huge hit. Then came retail therapy, shopping without even needing anything, just in search of the dopamine hit. Wow! And it does give you a buzz, at least for a few days until the credit card bill arrives and the dread sets in.

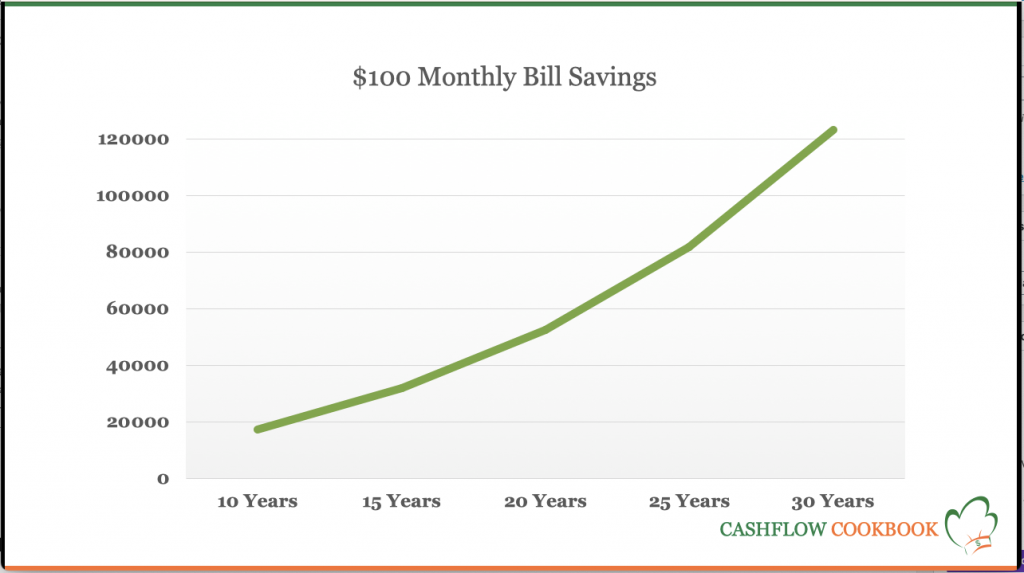

Money can buy happiness when it buys freedom, much more than when it buys things. If the focus of money shifts to future freedoms from today’s things, everything changes. The gamification comes through watching your wealth grow and setting up financial wellness for the future. Small changes make a big difference over time. This is especially true for recurring expenses. Let’s say we call a provider (cell phone, insurance or internet) every six months to optimize our bill and by doing that we can save $100 a month which we invest at 7% in a registered account. Here is the effect over time:

Wow. Turns out Einstein was right. We could retire with an extra $123,000. Not bad considering that the average North American retires with a net worth of just about $200,000. And notice that we didn’t actually give anything up, other than a phone call every 6 months. Oh and that was just one item! What other bills can we look at?

Elegantly reduce expenses

Earlier, we referenced the idea of a spending tug of war. It seems like a win/lose, zero sum game proposition. Enjoy your money now, or save it for future financial wellness. But the reality is much sexier than that. We can have both through some more elegant spending decisions. It turns out that there are simple ways to save on every category of spending. With no haggling, no yelling and no sacrifice. I got curious about all of this in 2015 and started a list that morphed into a book that includes $13,000 of monthly savings ideas. Get a copy on Amazon or here. Maybe the best investment ever.

Apply to Debt or Investments

Once you find a spending hack, that frees up, say $100 a month, it’s yours to keep. Buy a new pair of jeans every month, find something to spend it on at the mall or drink it down at the bar.

Or you could use it to pay down debts faster. Or increase your monthly contribution to your IRA or 401k (or TFSA or RSP for my Canadian friends). That’s where the magic happens. That $100 a month becomes $123,000 by the time you retire. And that is just one savings area. What if you could free up $400 a month? Or $2,000? Lots of my clients and readers do. It means they can retire with a lot more. Or retire a lot earlier. Or just lower the monthly burn to the point where it doesn’t need to get funded on credit cards. They stop worrying about money. If you really want to kick your wealth into gear, check out this idea of surfing to wealth.

Whether you are desperate to get out of debt, or keen to grow your investments, these simple principles make a big difference.

Part 3 looks at some more wealth building examples through more mindful spending as well as some other powerful engines to boost your wealth.

What clever savings ideas do you have? Let me know in the comments.

Glider Photo credit by Konrad Wojciechowski of Unsplash

2 Comments

Amazing! I was really looking forward to this weeks post and immediately put 10% of my income away. As a millennial, am I at the peak time to begin making lifestyle changes and to start thinking of my future? Or have I missed some key years? Or do I still have time to spend stupid? Can’t wait for next weeks article!

Fantastic Frankie. Your timing is perfect. As a millennial you likely have 30 or more years to grow your wealth. Saving 10% is a great start. Set up a tracker for your wealth and use ideas from my blog and book to continuously spend smarter, free up and invest more and accelerate your wealth. Keep us all updated on your progress!