How to beat bank savings rates

Sometimes you wonder how they say it with a straight face. Two tenths of one percent? How can they even call it a savings account? At 0.20% it would take 360 years to double your money. If you invested all of your earnings at 0.2%, moved back in with your parents, skipped coffee and cut your own hair, you still couldn’t retire before 136. There has to be a better way to invest. So how do you beat bank savings rates?

And what of those articles comparing bank savings rates? In depth comparisons of banks paying 0.74% on their accounts vs a paltry 0.20%. Why bother with the comparison? What difference does it make? Say you had $50,000 to invest. At 0.74%, at the end of a year you would have made $370 of interest and the government would take away, say 30% in taxes, so you are left with $259. At 0.20% you would pick up a tidy $100 in interest, with the tax person taking her $30, leaving you with $70. So at the end of the year, by shopping for savings rates, you would be ahead by $189. That might net you a dinner for two with wine, but not a real wealth builder. So shopping around isn’t a way to beat bank savings rates.

Short term vs long term

For short term goals, you have little choice. You need somewhere to accumulate money that won’t fluctuate, lest a chunk of it vanishes just as you need it. The low interest rates are the price you pay for some certainty that you won’t take a loss right when you need the cash. But for longer term savings goals like retirement and building wealth, you need exposure to stocks to create growth.

How do we know that stocks rise over time?

Over time, stock markets rise. That has been proven over decades, through wars, depressions, pandemics and whatever is coming next. What are my predictions for next week, next month or next year? No idea. And neither does anyone else. But why do they rise?

Most of you likely work for an organization of some sort. And that means you have a boss sending pressure your way to do your part to help the company make more money, look for ways to do things cheaper, avoid expensive lawsuits or hire people who can do all of the above. Sure, there are a few slackers, but the rest of the company feels that same pressure and is working hard to perform. If it is your own company, you know all of these same pressures, except it is you sending the pressure to yourself. The net of all that hard work is growing profits which increase the value of the company and its stock.

If you owned stocks in that company, you benefit as all of those people make sales calls, slash costs, reduce taxes and grow the company, all while you do nothing. Not bad. Now suppose you own stocks in a few companies instead of just one. If some are mediocre, the rest will likely cover them as all of those people all work to get their bonuses, while their bosses try to get their larger bonuses, all the way up the chain. So owning the stock of a few companies protects us from the risk that the company will go out of favor, the CEO gets charged with something immoral or another company makes a better widget.

Could we own the whole market?

Well what if we could own a little bit of all of the companies that trade on the stock exchange? Wouldn’t that further lower the risk and improve our returns? And indeed it could! You can do that through Exchange Traded Funds (ETFs). You can buy them just like stocks, but they effectively give you a little slice of hundreds or even thousands of stocks. All full of employees working like the Dickens to make their bonuses as you binge-watch Netflix on your iPad. In fact, Netflix and Apple are in lots of ETFs, so you can even benefit by other people watching Netflix and buying iPads. Hmm. One of my favorites ETFs is Vanguard’s VTI fund. It includes thousands of US stocks, including Netflix and Apple.

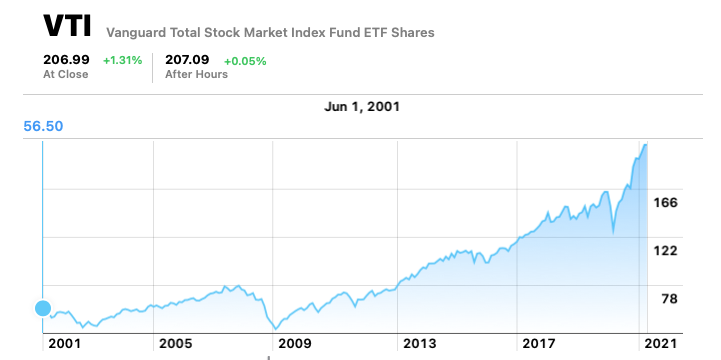

So how have these ETFs done over time? Can they beat bank savings rates? Well heck yah! Let’s look at VTI as an example. Here is its chart:

So 20 years ago, you could have bought the fund for $56.50 and today it would be worth $207. Not bad. It quadrupled over 20 years. That is the same thing as earning about 6.71% a year, every year for 20 years. But that’s not all, it also pays a dividend of about 1.3% which means that you would have a total return of about 8%. That’s a lot better than 0.2%

But what about the drops?

Imagine that you bought 1,000 shares of VTI in September of 2007. You would have paid $76,960 of your hard earned money to do that. But then the financial crisis hit and your investment would have sailed down to $36,810 in February of 2009. That is a drop of more than half. Ouch! Does that mean that even the stock market can’t beat bank savings rates?

No it just means that the market is unpredictable in the short run. It is still a great place to build wealth over the long run. Say you invested in January 2020 just before the virus hit. You would have bought in at $163.52. Just 2 months later your share would have plunged to $128.91. Ouch. But if you hung on for a full year until January of 2021, your share would be back to $193.99. A gain of nearly 19%. Over the short term no one knows what the markets will do. Over the long term they do well!

Conclusions

- The way to beat bank savings rates is to not use them to power your long term savings.

- Use savings accounts as short term money storage.

- To build wealth use a mix of stocks and bonds that are aligned with your age, stage and risk preference

- Exchange Traded Funds can be a low cost way to add exposure to the stock market with lots of diversification

- You can augment Exchange Traded Funds with specific stocks if you are confident in certain investment themes. Read more on that here.

- When you buy any kind of stocks or ETFs, remember that you are holding them for the long haul, don’t read the headlines or be tempted to sell at every piece of bad news.

- If you aren’t confident investing on your own, retain a competent investment advisor

- As you get closer to any goal, including retirement, you may wish to reduce volatility with a heartier mix of bonds and cash.

I have used Vanguard’s VTI fund for illustrative purposes. Investors should conduct their own research or consult a financial advisor. I hold VTI as part of my investment portfolio.

To free up more funds for investing, check out my blog and Cashflow Cookbook where I detail ways to free up to $13,000 of monthly savings.

What are you doing as an alternative to beat low bank savings rates? Please let me know in the comments and share this post to help others!

photo credit Roman Synkevytch on Unsplash

2 Comments

Great articles

Thanks so much John! Let me know other areas you would like me to cover. Gordon