Utensils

Utensils are tools that can help you set up and track your financial progress. They are useful on their own and really powerful when used as directed in the book Cashflow Cookbook.

Click on the images to download the file.

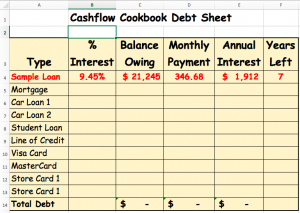

Debt Tracking Sheet

Having debts lurking about in credit cards, student loans, mortgages, car loans and various other things is no fun. They slurp away at your bank account like a colony of vampire bats leaving you dry 3 days before each pay check.

Before we whack them with a rolling pin, we need to get them all up where we can see them. Download the handy Cashflow Cookbook Debt Sheet, enter in your debts (yes all of them) and start to grind them down one a time, starting with the highest interest rate one. Use the savings from the Recipe section and Cashflow Cookbook to free up cash to eliminate these debts.

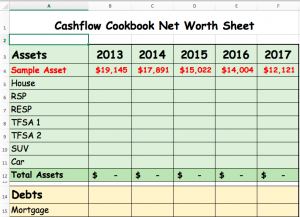

Wealth Tracking Sheet

Keeping a monthly budget is painful. Like a case of food poisoning from post-peak Thanksgiving leftovers. Easier to find new ways to save and apply them to debt reduction and increased savings. So how do you track all of this to see if it is working? By downloading the Cashflow Cookbook Net Worth Sheet. Fill in everything you owe and everything you own. Update it every few months and see how you are doing. Takes an hour or 2 a year and it will change the way you look at spending and saving.

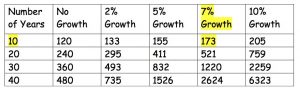

What Are Those Monthly Savings Worth Over Ten Years?

What’s with these people bringing lunch to work, collecting points at the supermarket and shopping around for mortgage rates? Which of these are worth the effort and which are just, well, effort? Download this PDF to get a handy table with instructions on how to convert a monthly savings to its value over a number of years at a particular interest rate. This table is referred to extensively in the book Cashflow Cookbook.

Debt Calculator – Credit Canada Debt Solutions

Ever wonder which credit card to pay off first? Or what the total interest cost will be as you pay off your debts at a particular payment level. Credit Canada’s site has this brilliant calculator that does exactly that. You can try increasing your monthly payments to accelerate the pay down and see how much interest you will save. Where do you get the extra funds to increase your payments? From Cashflow Cookbook recipes and blog posts!

TV/Internet/Phone Cost Reduction Script

Costs of these services can be considerable, especially if you have a teenager or 3, a partner, a vacation property and fellow residents looking for a lot of bandwidth, channels, gigabytes, new devices and whatnot. The providers of these services need some gentle encouragement once a year or so to make sure your costs are optimized. No need to yell, cuss or get antsy. Know that the call will take about an hour, but if you can save, say, $100 a month, that is $1,200 a year, one helluva return on your hour. Call the main number for your provider (let’s call them the “yellow” company), press the button to get to sales, let them verify who you are and your account number, grandmother’s maiden name, mark on your grade 9 math test and then here you go: <click on the image below to download the script>

“Oh yes, hi there, thanks so much for taking my call. I am just going through all of my bills and I have to say that my <yellow company> bill is really high. My last bill was <last bill amount>. That is a pile of money. There must be some way to reduce that. These are hard times. I was going to just call the <purple and green> companies and check their pricing, but I thought I would call you first since I would like to stay with you if I can.” At this point, one of 3 things will happen:

- They may transfer you to their retention reps. That’s good. They are the ones with the juicy offers. Be sure to work deals on each of the services you get from them. The savings should be considerable. If not, ask what else they can offer. Write everything down including the name of the rep and the new deal. Be gracious. Check your next bill for the savings.

- They may try to reduce your services, or offer a paltry discount. Don’t fall for that. Reiterate that you will need to call the other providers if they can’t do better. That should get you to the retention reps then you are back in number 1 above.

- They may want to move some of your other services over to them. That may be worthwhile. Compare to what you are currently paying. As in 1, work your best deal and record the details.

Some closing thoughts. Be nice. The company wants to you stay. It will cost them a few hundred dollars to replace you so you are all rowing in the same direction. There is nothing to fear in this call. Worst case you get no discount and you find savings elsewhere. Whatever discount you secure, immediately increase your debt repayments or your monthly investment amounts by the same value to make those savings work for you