You wouldn’t think that your VP of HR would be the one to turn you on to premium vodka. Yet there I was. During an after work drink (sadly that fad is gone), I ordered a dry vodka martini with olives. Donna gave me a slight sneer and then ordered a Grey Goose with a twist. Ugh. Was that a career limiter?

And so it was that I came to settle on The Goose as my standard. Decades later, I read an article that suggested that all vodkas are alike and there was no point in spending extra on premium brands. Hard to believe. Here in Cleveland, we started drinking Tito’s Vodka for no reason in particular and I did notice that it seemed a tad harsh. Penance for betraying the Goose perhaps. And so it begged the question: Is premium vodka worth it?

Quite separately, my wife, Deb, and I were noodling fun, Covid-safe entertainment ideas and I offered a formal vodka tasting night. Good entertainment value, staying within our household bubble and it would answer that niggling vodka enigma once and for all. Deb smiled and nodded and it was to be.

The preparation

Deb did the shopping trip, asking the liquor store clerk for 5 bottles of 80 proof vodka, from premium to bargain and then had them packed, sight unseen, into a stapled brown paper bag. We pressed Deb’s daughter into service, labelling 5 glasses with the numbers 1 through 5, each with about 2 ounces of mystery hooch. Hidden behind our bar, in a sealed envelope, Ruthie left the intoxicant index. I prepared a tray of appetizers for palate cleansing and some sustenance value to keep us upright through the research. We were each equipped with a note pad, pen and years of drinking experience.

The methodology

We began with a sequential sampling while making confidential tasting notes. I tucked into Vodka 1 – fairly smooth with a clean finish. Not too boozy. A decent start for sure. A bite of an appetizer and then a mindful sampling of Vodka 2. Hmm. Quite noble, almost buttery, perhaps a bit harsh on the way down. I mulled the two in my mind as I savored my reduced salt Triscuit with vegetable cream cheese topped with two half grapes. On to the third. Quite decent, maybe the best of the bunch so far, with a meatier viscosity and a medium boozy finish. I glanced at Deb as she pondered her fifth taste…time to pick up the pace. Number 4 seemed pleasant enough, but was it as buttery as the others? And what of its relative viscosity? On to 5. Less mindful. Was it a little harsh? A bit reedy? Is premium vodka worth it?

What was Deb thinking?

I set down my cup and checked in with Deb. We agreed to compare tasting notes. Five was her overall favorite since it seemed to be the smoothest, but she was also partial to 2. I felt that 3 was maybe the best and mentioned about the superior viscosity. Deb gave me one of those “always an engineer” looks but gave 3 a re-test. While we each had a quasi favorite, neither was willing to fight for their grog. Who would have thought that drinking vodka could be this tough? Still, it beats working for a living. And if it is this hard to decide during a structured tasting, is premium vodka worth it for home purchase or bar consumption? More importantly, how would we pick a winner?

What would my eye doctor do?

I thought back to my last eye exam and recalled the endless inquisition of ” A or click B, and click click,, now C or click D?” Could that work here? I covered the numeric labels and handed Deb 2 and 5 to test, calling them A and B and making a clicking sound between each. Deb liked A better, not realizing that she had just abandoned 5, her overall favorite. I then paired up the rest, taking her to Vodka 4 as her overall winner. She repeated the ophthalmologist routine with me, sans sound effects. I ended up with 2 as my overall favorite, viscosity be damned. Neither of us had conviction in our choices.

The big reveal…

We opened the envelope and had a few surprises. My initial pick was my old friend Grey Goose. But I abandoned that during the eye doctor testing and ended up with Absolute. WTH? Deb had picked our lowest price brand initially but landed on Tito’s as her favorite. But by the end of the second round of testing things didn’t get any clearer. As we polished off the cups as part of our bar clean up, things may have been even less clear.

Our Conclusions

- A vodka tasting night was a good switch-up to our Covid repertoire of Netflix, TV and watching movies.

- We had no idea which vodka tasted the best.

- Our new favorite vodka is New Amsterdam. Unless something else is on sale.

- We likely don’t drink enough vodka to get rich by switching brands, although that may not be true of all of our friends. You know who you are.

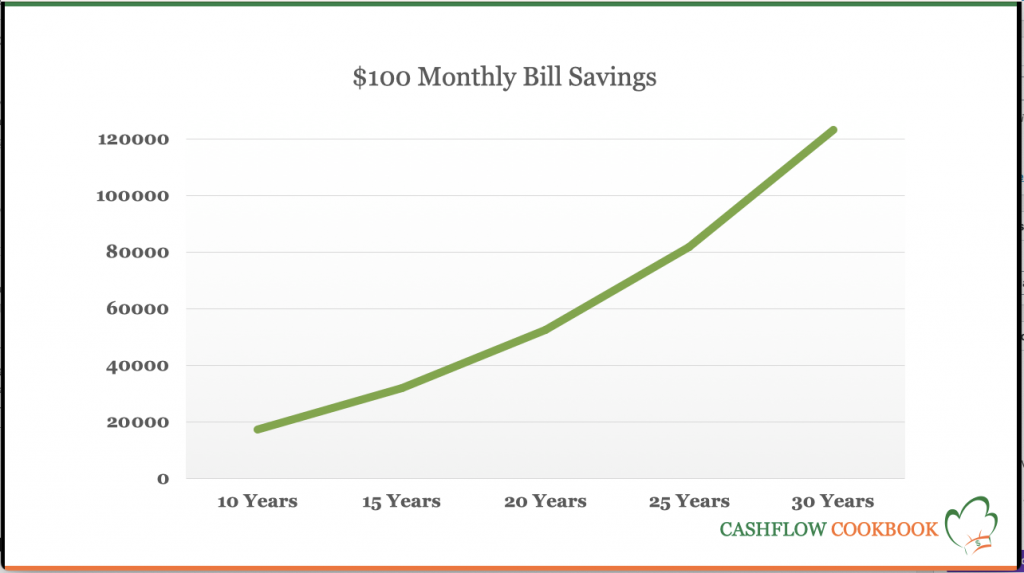

- There is always a smarter way to buy everything. This one was just for fun, but it shows that I have been over paying on something by more than 2.5 times. For no reason. Over 40 years of drinking, might that extra cash have done better investing in alcohol stocks rather than the premium brands? Let’s take a look!

In the chart above the golden line shows the growth in the S&P 500, a proxy for the overall growth of the US stock market. The other lines show the growth of the stock prices of three major alcohol companies, Diageo (DEO), Brown Forman (BF.B) and Constellation Brands (STZ) over the last 10 years. Buying cheaper vodka and investing the difference would have been a path to wealth! Remember that past results may not be indicative of future results and that readers should do their own research or consult a registered financial advisor on any investment. This chart and these securities are for illustrative purposes only. Most stocks won’t grow at anything like this rate, but being careful with your spending and investing wisely will make a big difference over time.

A big thanks to Deb for her testing help and some good laughs as we adjudicated the elixirs.

Next week, I’ll be back with Part 3 of How to Stop Worrying about Money. If you missed Part 1 or Part 2, go get caught up now so that you are ready for Friday.

What are your thoughts on vodkas? Can you tell the difference? Let me know in the comments below.