Retire early, love every minute

There is a lot of focus on the FIRE movement (Financial Independence, Retire Early). Lots of ink spilled on homemade cleaning supplies, tin foiling windows and clipping coupons whilst whilst living in a nano house. All in an effort to mass up cash, exit the rodent race and find freedom. Does the math add up? And if you get there, is there happiness? And, of course, will you run out of money? I think yes, possibly and done right, your cash keeps growing. Retire early, love every minute. Let’s take the pieces one by one:

How to retire early

Financial wellness isn’t complicated. In fact, it’s dead simple. Forget the get rich schemes, the lottery tickets and the hot stock tip. Find work that meets these criteria:

- Something you love

- A skill you are good at

- An offering the world needs and values

If you add a dash of hard work and innovation, you will be successful. Stay with it for a while. Think twice before you email your boss angry. Smile a lot. Befriend your HR team. Along the way, be sure to squirrel away at least 10% of what you earn, invest it well and you will retire eventually. Up the savings to 20% or 30% and you can retire a lot sooner. How much sooner or wealthier?

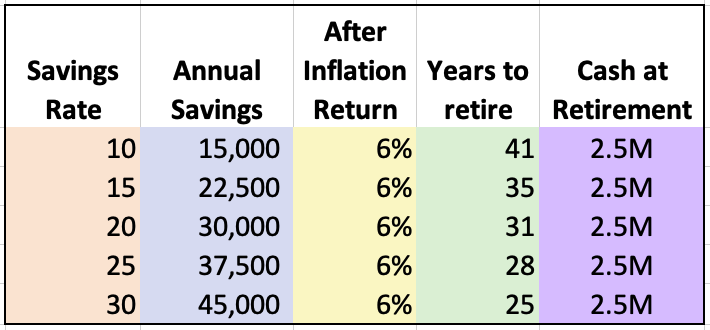

Let’s take a look using the example of someone who earns $150,000 for their entire career. A long plateau, granted. Let’s assume they want to retire with an annual budget of $100,000. The usual rule is that they can draw down 4% of their retirement account. This implies a saved stash of $2,500,000. How long does it take to get there if they can earn 6% after inflation?

Assuming they started working at 23, a 15% savings rate would have them retired at 58, while a 30% savings rate would have them on the golf course at just 48. Not bad.

Is it possible to actually save 30%? I think that it is. Simple changes like shopping your car insurance, saving on pharmaceuticals or slashing housing costs can make this a reality. Heck, even buying vodka smarter can help. But it raises a more important question in this race to retirement. Namely, what’s the rush?

How to love every minute of it

I had an interesting conversation with my eldest son a couple of weeks back. Kind of a future-musing session. It was nice. He mentioned that it would be cool to retire early. I asked what he would do if he was retired. He painted a picture of doing some writing and speaking, playing music, doing some biking and skiing and finding ways to help others. We both laughed. A lot like the lifestyle of the old man.

Many people idolize early retirement since they see it as a way of escaping a working life they hate. They are running from their current career. How big is the issue? A Gallup poll indicated that 85% of the full time working population are unhappy with their toil. With 1 Billion people working full time, that is 850,000,000 sad souls dragging their sad butts off to the office, plant or field. No wonder everyone is trying to retire.

But rather than running from something you hate, might it make more sense to run to something you love? A possibility is to change your existing career to something that offers you more meaning. A cause that you can embrace. Could you crunch numbers for a group whose mission inspires you? Or craft code for a company that is solving a massive human issue? Or switch to a new line of work where the work itself is more meaningful?

After retirement, you are still you

It’s just an arbitrary date. A mostly North American concept of a finite end of a career. Followed by an abyss of non-work. Sure we can advance the date, but meaning, joy and fulfillment don’t just arrive. They need you to invite them. Find them while you are still “working in your career” or look them up “after you retire” But they won’t crash your retirement party to save you. There is no “work”, then “post-work”. It’s just a continuum of life along which we all need to craft our personal ribbon of joy.

What brings us joy? Certainly the triumph of learning new things. There is happiness in accomplishments, particularly the more impossible ones. Stretching ourselves in multiple ways adds some intrigue. And nothing unlocks fulfillment more than the key of helping others. And let’s tack on completing whatever bucket list items are left.

Financial wellness opens the possibilities

Perhaps it’s not the surly bonds of our jobs we hate, its the perception of limited choice. Without financial security, it’s harder to take risks. How will we service our debts? Whither our families if we fail? Maybe the real quest is to get to a point of financial freedom, of living below our means, so that our capital rises whether we work or not. The joy of choice.

I joined a retirement session on Zoom recently. The group leader began by saying that we are all in a period of physical and cognitive decline. The curse of the post-50 set. Inspiring! Heck of an opening. I see the opposite. With some financial freedom and advanced years, we have new tools that we didn’t have when we were younger:

- The choice to chase a dream

- Money to invest in ideas and in ourselves

- Kids that are now self sufficient

- More patience to stick with things

- Lots of connections who can help

- Endless online information to learn anything

- Deep wisdom from years of wins and failures

- The freedom to surround ourselves with those who inspire us

An absent quest is a recipe for a bad movie and a sad retirement. There is no value in winning the financial race to retirement, only to wallow in aimlessness. Craft a life that brings you meaning, challenge, beauty and joy. Start a small business – it doesn’t need to make money. Learn an instrument – no one else needs to hear you. Tackle a challenge that scares you – cheer the win or the attempt. Help a group that really needs you – you’ll matter to them. Bask in fulfillment. Grin at the win. Enjoy.

But will I run out of money while self actualizing?

It’s interesting to actually give up the 8-7 (plus commute) life. No matter how many times you do the math, the fear remains. What if I outlive my capital? If you estimate that you can live on 4% of your savings, most financial models will say you are set. Now that I am actually living it, I notice a few things that should give you calm:

- You will draw down 4% a year, but your investments will likely average more like 8%. That means your money is growing, not shrinking most years. The 4% co era just the worst case. Test this at firecalc. It will run dozens of market scenarios. One will show you exhausting your capital at 90. The rest show it growing two three or four fold. The spray nozzle is crazy wide. A lot depends on Mother Markets.

- If you stay active and connected, most likely some fun opportunities will come your way. Coaching. Consulting. Investing. They can add income and leave your stash to continue growing like hostas.

- You will see some extra income from Social Security

- Your expenses may be much lower than you thought with kids grown, mortgages paid and homes decorated and furnished.

Now is your time. Whether you are 20 or 60, working or “retired”. Go live your best life. Scare and challenge yourself, appreciate all that you have. Help others. You got this.

What are your thoughts on retirement? Let me know in the comments.

Photo credit: the author. Taken mid day on a Tuesday as a cow crossing paused a kayak trip with a buddy. Blissful!

2 Comments

My view on retirement is not to retire until I have to. The entrepreneurial spirit is the best way to live. Yes, I still need to make money but it doesn’t own me like it used to.

Awesome Brian! I totally agree. The key is to build financial wellness so that you have options, then pursue something that you are passionate about. Pulling those two things together let’s you create a dream lifestyle. Mine is about fun, fitness, playing music and family. The “work” part is about helping others attain financial wellness through my blog and speaking engagements.