Reduce bill anxiety!

Ugh. There it is. That gnawing feeling that there is something not so good in your finances. Maybe you have a sense that you missed a past due bill? Perhaps a fear that those last few purchases put you into overdraft? Or maybe there is a masked money monster on your desk, lurking under a jumble of bills, bank statements, cat toys, tax receipts, charging cables and lint. Whatever the situation, let’s permanently reduce bill anxiety in your household.

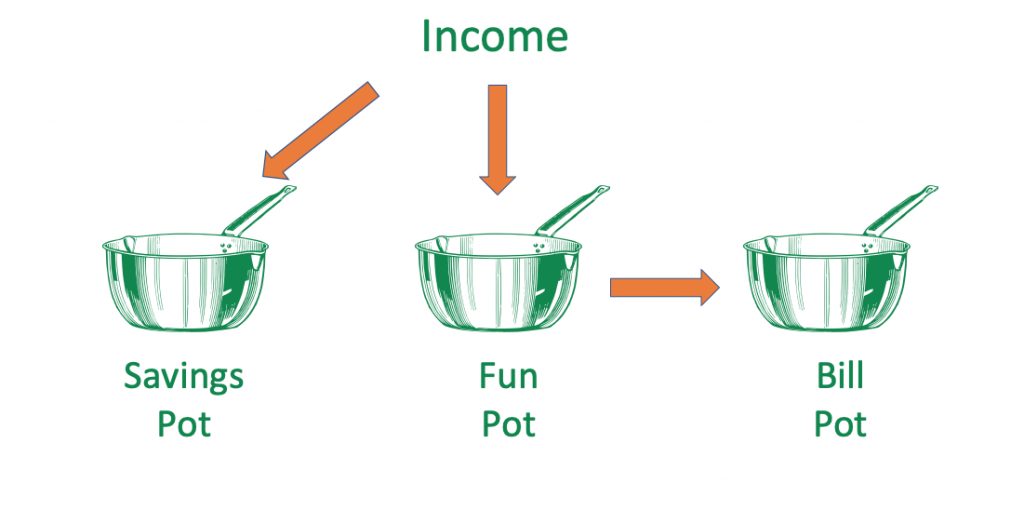

Let’s start by setting up your money into 3 pots:

Your Savings Pot

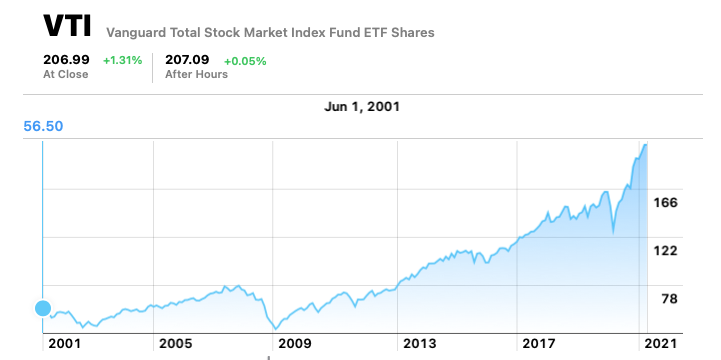

Your Savings Pot(s) are anywhere you send money to decrease debt or increase your investments. It might include registered accounts, work pensions, investment accounts or aggressive mortgage pay downs.

- Ideally, get your savings money payroll deducted and straight into your Savings Pot. If that isn’t possible then set up an automatic monthly transfer from your Fun Pot where your income gets deposited each month.

- Your Savings Pot is a priority. It sets you up for financial freedom. Do some quick math and see how much of your gross income you are saving.

- Add up how much you save each month. Include what goes into your registered accounts like your IRA, 401(k) (or TFSAs and RSPs for Canadians) as well as what you are saving in cash accounts and divide that by your monthly gross income.

- If the result is less than 10%, you need to free up some cash to increase your savings rate. Are you saving 10-20%? You are well on your way to financial freedom. Crushing it with a savings rate of 20-50%? Please reach out to me and let’s do a case study on you!

- If you are overwhelmed by bills, and can’t save anything at all, you may end up working longer than you would like. Find ways to grind down your monthly bills and/or your fun expenditures. Check out my blog posts or some of the ideas in Cashflow Cookbook.

Some savings come with extra sauce

- If your company offers company pension plans, company sponsored 401(k) plans or company stock plans it is their way of trying to give you free money! Don’t say no!. Look for ways to free up cash and participate.

- The government wants to help too! Tax advantaged plans like IRAs, 401(k) and 529 education savings plans (TFSAs, RSPs and RESPs in Canada) also provide free money by reducing the taxes you would otherwise pay. When your government offers free money, don’t say no to that either.

- Sometimes debt repayment can be the best place to ‘save’. As an example, say you are carrying $30,000 in credit card debt at 22%. If your tax rate is 40%, paying that off is like investing in a government bond that pays 36% interest! Bit of a no brainer. *

Boom! Savings are covered. Just let that pot simmer. Nothing to worry about, you are on track for financial freedom. As you earn more, be sure to generously top up your Savings Pot. On to the Fun Pot.

Your Fun Pot

Your Fun Pot is just a checking account where your paychecks or other income get deposited each month. An automatic monthly transfer pours bill payment money to your Bill Pot each month. The rest is yours to enjoy.

- You may want to do all your spending on a rewards credit card to pick up some cash or travel points, then pay off the card every month from your Fun Pot. I like the reward credit card finder from SmartAsset (or the rates.ca credit card finder for Canadians)

- If you share your finances with someone else, be sure to have regular communications about this account. What larger expenses are planned for this month? Where do we stand now and what trips, dinners and things are left to buy?

- With the bills out of the way in the Bill Pot, it is much easier to manage your fun money. No surprise bills coming out that kick you into overdraft hell. Less arguing about money. A way to reduce bill anxiety.

- Look for ways to get more for your fun money spend. Clever ways to share things vs buying your own? Better ways to buy things? Or even ways to save on vodka?

Your Bill Pot

Automating and streamlining your bills is a great way to reduce bill anxiety. Here are some steps to get things under control:

- Pull out each of your recurring bills (cell phone, internet, gas, electricity, insurance etc) and calculate the average monthly spend for each and total them up. Add 10% for good measure.

- Set up a separate “Bill Pot” account that is only used to pay your recurring monthly bills. This account will have 6-12 bills a month drizzling out and one monthly payment coming in. Find the lowest cost account that can do that.

- Set up an automated transfer for the amount in step 1, coming from your Fun pot into your Bill Pot once a month.

- Set up a browser favorites folder on your computer called “Household Bills”. Create accounts with each of your service providers with automatic bill payments coming from your Bill Pot Account. Bookmark each of them into your Household Bills folder. Lovely! While you are at it, select the paperless billing option. Add each of your bill accounts to your Household Bill folder on your computer and use a password manager so you don’t have to remember dozens of passwords like Ye$EyElike2Golf.

- Double check that everything gets paid as you transition between manual bill payment and this automated approach.

- Enjoy bill freedom. Throw out all of that paper. Let those companies do the filing for you. Want to retrieve an old bill? Have a sudden hankering to review last May’s gas bill? Go to Household Bills and peruse away. No hassles, no overdue bills, no paper, no stress.

The fine tune

Once you get everything in place and your bills pay themselves, you have managed to reduce bill anxiety, eliminate a lot of paper and automate your savings, it’s time to fine tune things:

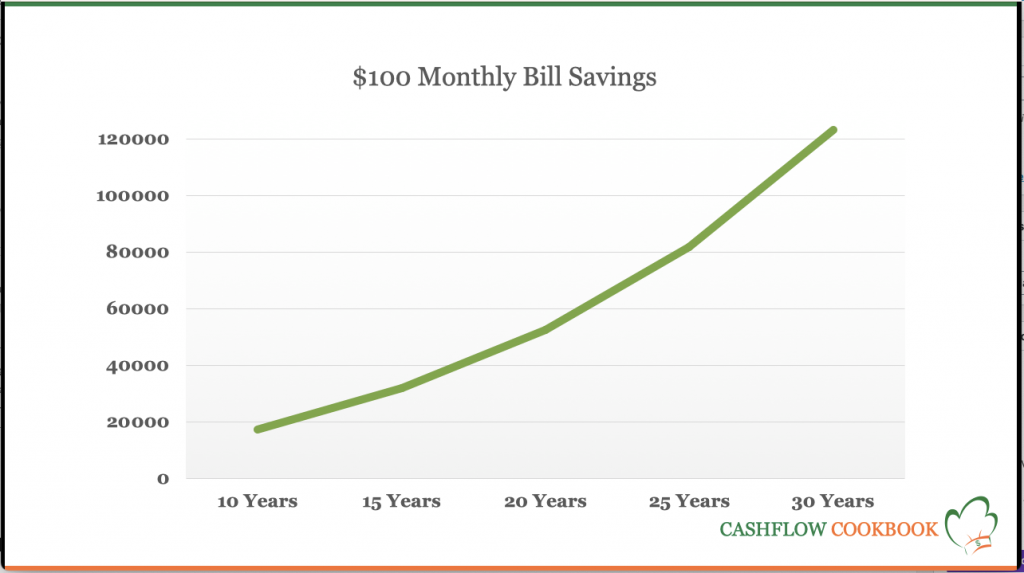

- Call each of your providers each year and make sure that you are on the best plan, getting the best rate and enjoying all of the discounts. They would love to hear from you. An example script for speaking with your cell phone provider is here. Some gentle mention of the competition or actual shopping of the competition never hurts. Once optimized, reduce the money flowing into the Bill Pot and increase your Savings Pot if you can. Set a reminder to call each provider every year or use online comparison tools like Zebra (For US car insurance) or rates.ca (Canadian car and home insurance, credit cards, life insurance and more).

- As you reduce these boring and painful bills, use the freed up cash to reduce the monthly transfers into your Bill Pot and increase your automated monthly Savings Pot contributions. If you are already saving 10-20%, then splurge with a higher Fun Pot.

- Not a bad idea to set up an emergency account or have access to a credit line to cover unforeseen emergencies like broken dishwashers, dog operations or car crash deductibles.

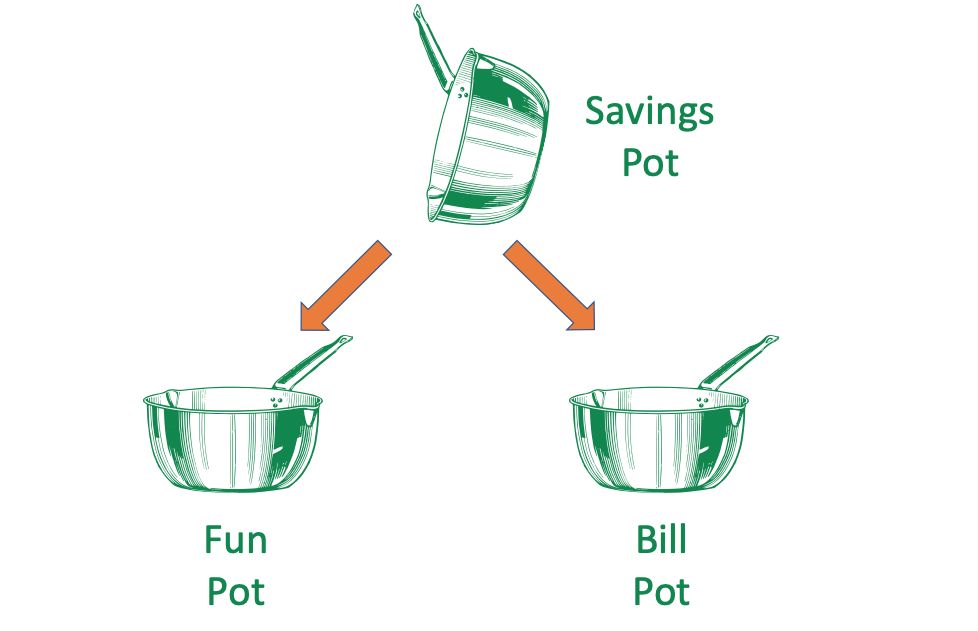

At Retirement

In retirement, keep going with your Fun Pot and your Bill Pot.

Your Savings Pot now replaces your income and just pours cash into the other two every month. Keep seasoning your Bill Pot by optimizing your expenses. Monitor your Savings Pot to make sure that you don’t outlast it. And enjoy yourself! You’ve earned it!

*If you want an explanation of this 36% government bond, leave a comment below and I will respond.

If you enjoyed this post, please subscribe to my blog, and share on social media.

How do you set up your accounts? What did I miss? Please let me know in the comments.