How cool would it be to get free iPhones for life?

Dream with me for a minute. Imagine brand new free iPhones every other year. And hey, if we are dreaming anyway, how about a free cell phone plan to go along with it? Pretty sweet. Since everyone likes free stuff, let’s add in $200 gift certificates from Starbucks, Lululemon, Starbucks and Chipotle. Even better. But is this really possible? And why would these companies give all of this away for free? More important, how can you get in on the deal?

Most personal finance writers would shoot down the idea of new iPhones every other year, fancy coffees, dining out and premium sportswear. I would too, if you actually had to pay for all of it. But what if there were a way to actually get it all paid for…every year…for life?

So what is the scheme and who actually pays for the free iPhones?

Over at Apple there are 147,000 employees. They are all working hard, dusting store fixtures, selling iPads, explaining nuances of iCloud and making all the boxes open slooowwwly. Meanwhile at Chipotle, people are opening stores, scrubbing grills and being incredibly patient while customers fuss over their exact burrito toppings. The Amazon folks are scampering around filling orders and whipping reindeer to get everything to your house on time (kidding on that last one). What are we doing while they are working so hard? Well, frankly not much. And therein lies the elegance of this approach to get free iPhones and other stuff.

As they are busy with all this ceaseless toil, they are growing their companies. Improving sales numbers, opening new stores and making their companies more money. The brands become more valuable and their success continues to snowball. The great products and experience keep the results coming and and their stock prices continue to grow. That stock price growth is what we can use to get their products for free.

Converting stock growth to free stuff

Ok. So far we have companies with products we want. Employees working like the Dickens. Stock prices rising. So how do we cash in and get all the free iPhones and the other cool stuff?

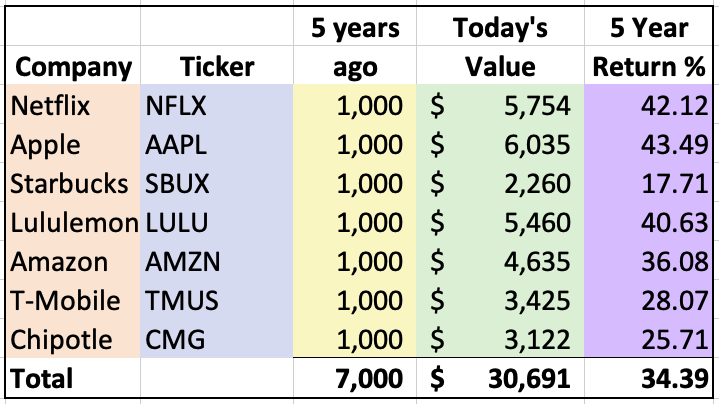

Imagine that we set aside $7,000 five years ago and bought $1,000 worth stock of each of 7 cool companies whose products and services we like. Let’s lay it all out in a table:

On the left is the company, their stock ticker in blue and an initial investment in yellow. $1,000 per company. Adding up the growth of the stock over the last 5 years, including dividends give us today’s value in green. Finally, the purple column shows the average annual return for each of these stocks. Wow! An average annual return for the group of 34.39%. They are all great companies with big competitive advantages. Will they keep growing like that? I have no idea. And neither does anyone else. But stay with me!

So our initial investment of $7,000 has grown to over $30,000. Not bad. There are lots of things that we could do with that cash. Usually, my counsel is to keep it invested, especially in an IRA or a 401(k). (TFSA or RSP for you Canadians). But this time, let’s assume that your debts are under control and you have a good start on your retirement savings.

Time for a little fun with our cash

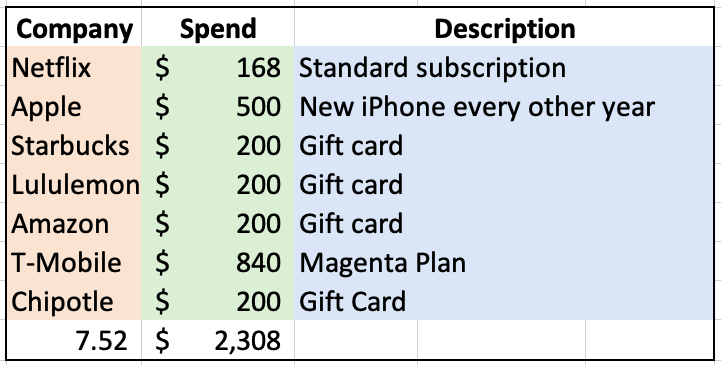

Rather than spend the money in a lump, or invest it for the long term, what if we just pull out each year’s gains after that initial 5 year growth period and spend it on fun stuff. What could we buy and how long could we keep this up? Let’s take a look:

So we will start with a new iPhone every other year for $1,000, or about $500 per year. Let’s add a cell plan and let it gorge on unlimited 5G data. Tasty. Tuck in a standard Netflix subscription. That adds up to $1,508. Then let’s spend $200 on gift cards from each of Starbucks, Lululemon, Amazon and Chipotle. That all ads up to $2,308 of fun stuff every year. Some nice lifestyle additions. Why those numbers?

So we will start with a new iPhone every other year for $1,000, or about $500 per year. Let’s add a cell plan and let it gorge on unlimited 5G data. Tasty. Tuck in a standard Netflix subscription. That adds up to $1,508. Then let’s spend $200 on gift cards from each of Starbucks, Lululemon, Amazon and Chipotle. That all ads up to $2,308 of fun stuff every year. Some nice lifestyle additions. Why those numbers?

They sum to $2,308 or about 7.5% of the value of our stocks. If our stocks grow at about 7.5% a year, we would be able to spend that much and not actually deplete our $30,691. In fact, we could enjoy free iPhones, cell plans, Netflix subscriptions and all those gift cards forever. $2,300 worth of stuff forever, all from a one time investment of $7,000.

But wait, it wasn’t free. We still had to invest $7,000 and wait 5 years.

Actually, you can get that initial investment for free. Or very close to free. Some careful re-shopping of regular bills can easily emancipate the cash for that kind of investment. All with minimal effort. Have a look at easy ways to reduce regular bills like energy costs, home renovations, housing costs, prescription drugs and even vodka expenditures. Want another $13,000 of monthly savings ideas? Check out Cashflow Cookbook.

What about the business of waiting 5 years for that initial investment to grow? Let me answer that with a story. When I was about 27, I started working on an MBA part time. People would often say “Part time? Are you kidding me? That will take you 4 years. You won’t be done until you are 31.” My answer was that I will be 31 eventually. I can either be 31 with an MBA, or without one. Life goes on, tuck away the money, go about your business and check your balance in 5 years. Hopefully you will have a fun account that spits out free iPhones and other goodies for life.

You can, of course set this up with whatever brands you like and nothing says you have to spend the growth and dividend money on the same companies you invest in. The investments are spread across 7 stocks which provides some level of diversification.

We got some free iPhones and some powerful learnings

A few things get reinforced with this example:

- Compound growth really is the 8th wonder. It can even keep you in iPhones.

- Great companies have brand power that fuels their growth and investment returns

- A group of strong stocks can provide an ongoing stream of money to fund a lifetime of expenses

- This is really a miniature version of the power of long term investing for retirement

- Invest for the long haul. Markets tend to rise over the long haul, but may rise or fall in the near term

Some caveats

Readers should always do their own research on any investment. This example was for illustrative purposes only and does not constitute investment advice. The author holds positions in Amazon and Apple. Investment results are unpredictable and past results may not be reflective of future performance.

What companies and products would you add to the list? Let me know in the comments below.

Photo credit Douglas Bagg at Unsplash