Have you summoned up the courage to check your investment returns? Overcome by the temptation to sell it all in case we face a Hollywood-style dystopian future? Or do you have some new money to invest and are terrified that it may get swallowed up by the Coronavirus, leaving you broke. In short, how to stay calm as the Coronavirus infects your investments?

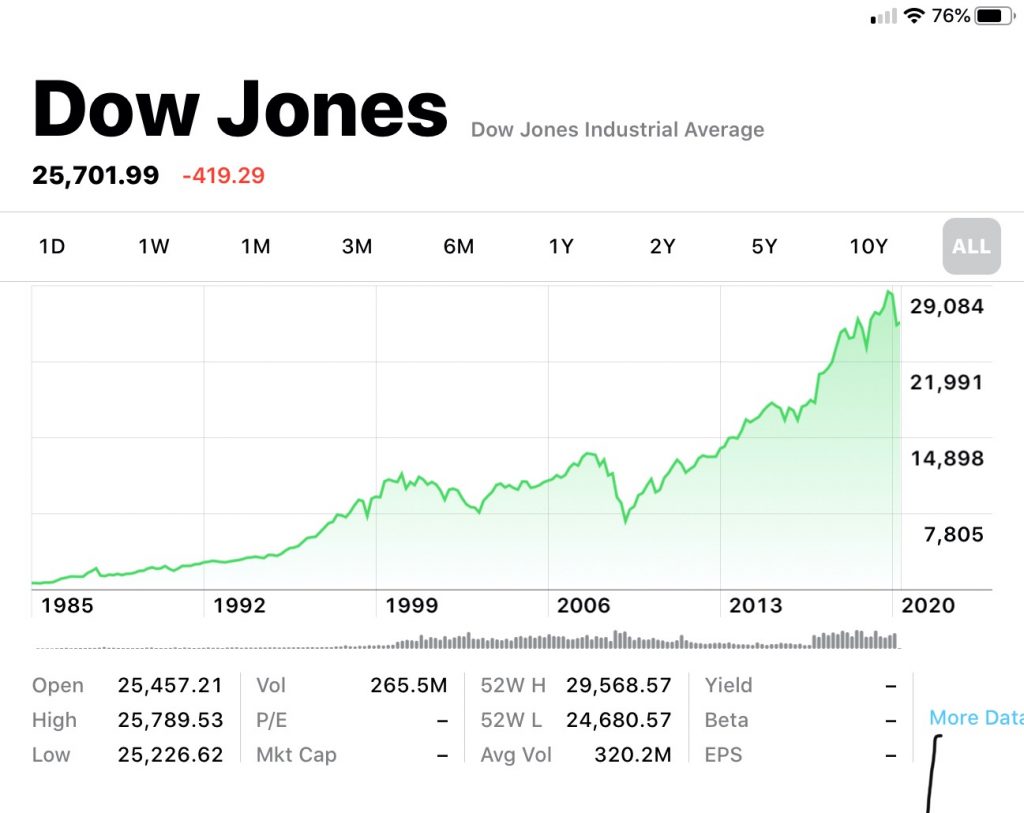

Let’s take stock. Of stocks. Over time. Back in January 1985, I was a fresh grad of Western University, with my first real time job, a full head of hair and some leftover muscles from my time in the college weight room. The Down Jones Index (a measure of the US stock market’s largest companies) stood at 1,286.77. It was a precarious time to invest since it was right after the 1981 recession. People lost homes. Jobs were scarce. But fast forward to today (March 6, 2020) and most of my hair and muscles are gone. But the Dow Jones index has risen to 25,701. If you held on to your investments since 1985 you would have seen an annual compound growth rate of 8.92%. Not bad! And that includes the big Coronavirus drop. Even better, your returns would have been bolstered by another 2% in dividends.

Key learnings about investing through a crisis

This long term growth happened despite the 1987 Black Monday crash that caused a drop of 33%, the dot com bubble of 2000-2002, the 9/11 tragedy and the 2008 financial crisis. In hindsight, they were all great buying opportunities, but at the time, they all felt like armageddon. This is the first time the Coronavirus is infecting your investments, but lots of other crises have taken a bite. Looking back, there are some key lessons to be learned:

- Stock markets can look scary in the short term. Here is the view of the Dow index as the Coronavirus fears hit:

Dow Jones Index during the Coronavirus crisis Ouch! Thats a big drop. And the red color adds to the sense of panic. Makes you want to sell and get out until the carnage is done. But here is a view of the same stock market index over the longer term. Almost hard to find those same crises as this collection of companies continue to grow their businesses over time.

long term view of the Dow Jones - The stock market is a long term investing vehicle. As Warren Buffet likes to say, “it is a device for transferring money from the impatient to the patient”. No one knows what it will do next week or next year, but over longer horizons it offers an opportunity to grow wealth. We know three things about crises: the current one will end, a new one will follow and through them all the patient investor enjoys long term wealth building. When I speak about financial wellness, audiences often ask how to attain returns of more than 2%. The answer is the stock market mixed with patience.

- When you buy stocks you are buying a part of real companies that move oil, make cellphones, create software and haul things around. Think like an owner, because you are one. Don’t buy and sell on emotion and whim. By owning a company, you have employees selling things, making things, writing reports and fussing about new ways to make you money. As an investor, you get to relax and watch TV on the couch and let them do the work and bring you the rewards. Enjoy that process.

- Invest in quality companies for the long haul, not hot tips from your work mate, hair dresser or the internet. The most speculative companies take a beating in a crisis. Blue chip companies simply carry on producing profits. Pipelines, telcos, banks, insurance companies and stable, on-trend technology companies can be great wealth producers over time.

- Include dividend stocks in your portfolio. The steady stream of dividends provide income if you need it, or they can be reinvested automatically (dividend reinvestment program or DRIP). DRIPS use the dividends to automatically buy more of the stock using the dividends. As a bonus, when stock prices drop, DRIPS automatically take advantage of the sale, buying more. Learn more about the beauty of dividend stocks here

- Diversify by investment type and by geography. Having some bonds in your portfolio cushions the ride. Since the Coronavirus drop happened on Feb 12, 2020, my Vanguard bond fund (BND) is up about 3.5%. Not bad. It also pays a yield of 2.6%, so the cash rolls in even as markets falter. Canadians tend to have too much invested in Canada which is only about 3% of the world market. Branching out to US and international markets is important to reduce risk and build returns.

Vanguard BND fund performance - If you lack investing knowledge or are prone to acting on emotion, get an accredited financial advisor in between you and your money. The cost of their advice can pay for itself if they can prevent you from acting in a panic, buying on bad tips or selling during a crisis. They can also help with tax and estate planning and a host of other financial advice. Shop carefully, they are not all created equal.

- When a crisis hits, like the current one, stay calm. Know that the companies you own will fall in value, but they will recover over the long term. Resist the urge to sell. Remember that no one rings a bell at a stock market low so that you know when to buy. And there is no buzzer that sounds at a peak warning us to sell. Accept that stock market gains and losses are part of the business of investing.

So how to stay calm as the Coronavirus infects your investments? Stop checking the value of your portfolio and trust the employees of all of those companies to continue to work hard and build you wealth. Stay in solid, well run companies and invest for the long run. Oh, and wash your hands!

To find ways to free up more cash to invest, have a look here.

Photo credit Ani Kolleshi at Unsplash.